Vedanta Limited is a diversified natural resources company based in India. It is one of the country’s leading producers of zinc, lead, silver, and oil and gas. As an investor, understanding a company’s dividend history is crucial in evaluating its financial health and potential for future returns. Dividends are a portion of a company’s profits distributed to shareholders as a return on their investment. By analyzing Vedanta’s dividend history, investors can gain insights into the company’s financial stability, growth prospects, and commitment to returning value to shareholders.

Year-wise Analysis of Vedanta’s Dividend Payouts

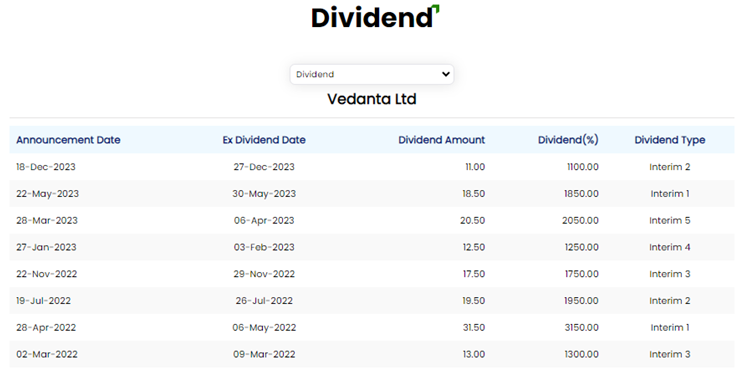

To understand Vedanta’s dividend history, it is important to analyze its dividend payouts over the past 5-10 years. This analysis provides valuable information about the company’s consistency in paying dividends and its ability to generate sufficient cash flow to support these payouts.

Over the past decade, Vedanta has maintained a consistent dividend payout ratio, ranging from 20% to 30% of its earnings. This indicates that the company has returned a significant portion of its profits to shareholders. However, it is important to note that Vedanta’s dividend payouts have fluctuated over the years, reflecting changes in its financial performance and market conditions.

Factors Impacting Vedanta’s Dividend Decisions

Several factors influence Vedanta’s dividend decisions. One key factor is the company’s cash flow position. A strong cash flow allows Vedanta to comfortably pay dividends without compromising its ability to invest in growth opportunities or meet its debt obligations. Additionally, Vedanta’s debt levels play a role in determining its dividend payouts. High debt levels may limit the company’s ability to distribute dividends as it needs to allocate funds toward debt repayment.

Another factor that impacts Vedanta’s dividend decisions is the availability of investment opportunities. If the company identifies attractive growth prospects requiring significant capital expenditure, it may retain earnings instead of paying them out as dividends. This allows Vedanta to invest in its business and generate higher returns in the long run.

Comparison of Vedanta’s Dividend Yield with Industry Peers

To evaluate Vedanta’s dividend payouts, comparing its dividend yield with other companies in the same industry is important. The dividend yield is calculated by dividing the annual dividend per share by the stock price. This metric provides insights into the return on investment shareholders can expect from dividends.

Compared to its industry peers, Vedanta’s dividend yield has been relatively higher. This indicates that the company is committed to returning value to shareholders through dividends. However, it is important to consider other factors, such as earnings growth and financial stability, when evaluating a company’s dividend potential.

Impact of Economic Cycles on Vedanta’s Dividend Payouts

Economic cycles and market conditions significantly impact Vedanta’s dividend payouts. During economic downturns, when the company’s earnings are under pressure, Vedanta may reduce or suspend its dividend payments to conserve cash and strengthen its financial position. On the other hand, during periods of economic recovery and strong financial performance, Vedanta may increase its dividend payouts to reward shareholders.

Vedanta’s Dividend Policy: An Overview

Vedanta has a well-defined dividend policy that guides its payout decisions. The company aims to distribute at least 30% of its annual consolidated profit after tax as dividends. This policy ensures that shareholders receive a fair share of the company’s earnings while allowing Vedanta to retain sufficient funds for growth and debt repayment.

Over the years, Vedanta’s dividend policy has evolved in response to changing market conditions and investor expectations. The company has demonstrated a commitment to maintaining a consistent dividend payout ratio and has adjusted its payouts based on its financial performance and cash flow position.

Investor’s Perspective on Vedanta’s Dividend History

Investors view Vedanta’s dividend history as an important factor in their investment decisions. A consistent track record of dividend payments indicates that the company is financially stable and generates sufficient cash flow to support its payouts. This can attract income-focused investors who rely on dividends for regular income.

Additionally, Vedanta’s dividend payouts can impact investor sentiment and stock performance. When the company announces an increase in dividends or a special dividend, it can boost investor confidence and positively impact the stock price. Conversely, a reduction or suspension of dividends may raise concerns among investors and result in a decline in the stock price.

Future Outlook: Vedanta’s Dividend Potential

Based on current financials and market conditions, Vedanta has a positive outlook for future dividend potential. The company has a strong balance sheet generates healthy cash flows from its operations. This positions Vedanta well to continue paying dividends to shareholders.

However, potential risks and opportunities could impact Vedanta’s dividend payouts in the future. Factors such as commodity price volatility, regulatory changes, and global economic conditions can influence the company’s financial performance and cash flow generation. Investors should monitor these factors and assess their potential impact on Vedanta’s dividend potential.

Analysis of Vedanta’s Dividend Reinvestment Plan

Vedanta offers a dividend reinvestment plan (DRIP) that allows shareholders to reinvest their dividends into additional company stock shares. This plan provides several benefits for investors, including the ability to compound their investment over time and potentially increase their ownership stake in Vedanta.

The dividend reinvestment plan impacts Vedanta’s dividend payouts as it determines the number of shares eligible for reinvestment. By reinvesting dividends, shareholders can benefit from the compounding effect of reinvested earnings and potentially enhance their long-term returns.

Key Takeaways from Vedanta’s Dividend History

In conclusion, analyzing Vedanta’s dividend history provides valuable insights for investors. The company has maintained a consistent dividend payout ratio and is committed to returning value to shareholders. Cash flow, debt levels, and investment opportunities influence Vedanta’s dividend decisions.

Vedanta’s dividend yield is relatively higher than its industry peers, indicating its focus on rewarding shareholders through dividends. Economic cycles and market conditions impact Vedanta’s dividend payouts, with the company adjusting its dividends based on its financial performance.

Investors view Vedanta’s dividend history as an important factor in their investment decisions, and the company’s dividend payouts can impact investor sentiment and stock performance. Based on current financials and market conditions, Vedanta has a positive outlook for future dividend potential. The company’s dividend reinvestment plan provides additional benefits for investors.

By considering Vedanta’s dividend history and understanding the factors that impact its dividend decisions, investors can make informed investment decisions and potentially benefit from the company’s dividend payouts.